Whether you’re looking to invest in commercial real estate in Alaska or are simply searching for the right office building or property for your business, you likely have dozens of questions on your mind. Questions surrounding the location, price and space will arise and you will find yourself wondering if Anchorage AK commercial real estate is the best investment for you at this time. So how do you determine if you’re making the right decision? It’s time to consider the “I.D.E.A.L” factor.

What is the I.D.E.A.L Factor?

I.D.E.A.L is an acronym that allows us to quantify some of the advantages of real estate investing. It is also an easy-to-use (and remember) model that will help you to determine if you’re making the right move by investing in Alaska commercial real estate.

I: The “I” stands for income potential and inflation hedge. Real estate is typically a good hedge against inflation as property value and income generated from the properties both rise to stay on pace with inflation. This is the cash flow component of your commercial real estate investment.

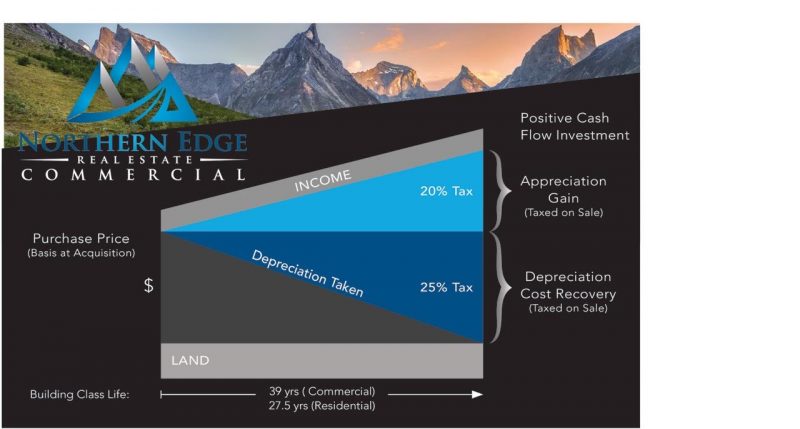

D: The “D” stands for depreciation. Building improvements (not the land) can be depreciated based on a depreciation schedule, which varies according to whether the investment is commercial or residential. For commercial investments, the depreciation schedule is typically based on 39 years and for residential, 27.5 years. When you sell the asset, Uncle Sam gets some of your depreciation benefit back in the form of a 25% cost recovery tax.

E: The “E” stands for equity build-up. As you pay down your amortized mortgage, the value of your investment and thus, your equity, will rise. If you are the owner of income-generating property, it is precisely this amortization that can equate to your tenants actually helping to build your estate.

A: The “A” stands for appreciation. This refers to the goal of every property owner— that your property value will rise every year. When you sell the asset gains are taxed at 20%.

L: The “L” stands for leverage. When you buy commercial real estate in Alaska and make a down payment of 25 percent, borrowing the balance, you still receive the benefit of 100 percent of the investment. Regardless of the fact that you only put 25 percent of your own money into the project. If you borrow the money at 6 percent and your investment returns 8 percent, for instance, you then have positive leverage. You are making money on the money borrowed from the bank. The use of a mortgage allows for you to use small amounts of money to gain control of larger investments which in turn, can earn you larger returns on the money you’ve invested.

Investing in commercial real estate can be one of the most lucrative moves for you this year, but only if you do the necessary research and due diligence. For more information about commercial real estate in Anchorage or for a list of available properties, do not hesitate to reach out to Northern Edge Commercial.

We look forward to hearing from you!