Higher is not always better.

In a previous article, we reviewed the CAP rate as an initial indicator of value in Alaska commercial real estate. Now, let’s break down a couple common pro forma line items and explore how these variables affect CAP rates and the risk profile.

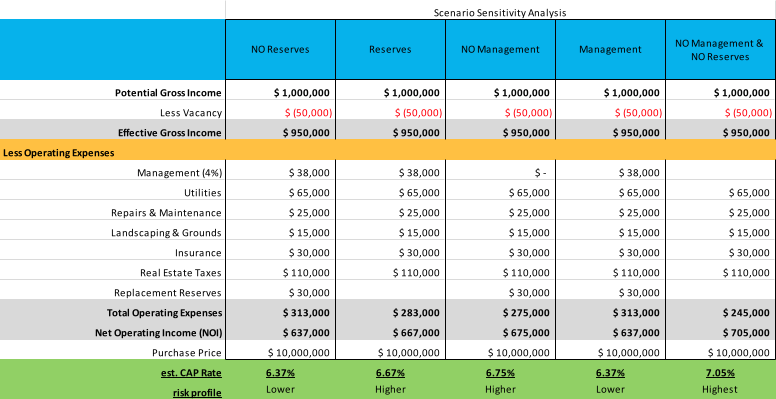

Reserves vs. No Reserves

Capital reserves are often overlooked by investors and in the Alaska commercial real estate market, it’s no different. Our analysis indicates that even the most prudent investors often pro forma as much as $.75/sf/yr for capital reserves— especially on older buildings. One example of how this can affect an investment is to review a pro forma with actual numbers and overlook the need for a new roof in five years. Your financial indictors may look promising as you head into the investment, until you get the vil for the new roof in five years. By setting up a fund in the form of annual capital reserves, you change the going-in CAP rate and also decrease the risk profile for the asset by establishing a rainy day fund.

Management vs. No Management

Properties that have built-in management—or are owner-managed—often do not include third-party management fees in their pro forma. All the while, having a management company oversee an asset can reduce the operational risk of the property and including a management fee on the pro forma can result in a lower CAP rate— with all other things held equal.

A lower CAP rate implies a lower risk profile for future income streams. See Table 1 comparisons.

Table 1 represents a basic sensitivity analysis using extracted CAP rates to represent risk profile changes. For the purpose of this analysis, only one or two variables (Management and Capital Reserves) were adjusted. However, in reality, multiple variables will often need to be adjusted in order to compare active investment opportunities or evaluate them with respect to market trends and sales.

All too often, investors tend to be pre-occupied by their seemingly “great” investment purchased at a 10 CAP rate and as a result, lose sight of the risk profile associated with that particular asset. Remember, nothing is guaranteed. With a 10 CAP at acquisition, what you initially believed to be a “great” investment may ultimately turn out to be a bad one.